vermont state tax brackets

Tuesday January 25 2022 - 1200. 40351 - 9780067451 - 163000.

File Top Marginal State Income Tax Rate Svg Wikipedia

2017-2018 Income Tax Withholding Instructions Tables and Charts.

. Tax Year 2021 Personal Income Tax - VT Rate Schedules. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

2017 VT Tax Tables. 4 rows Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax. Read the Vermont income tax tables for Married Filing Jointly filers published inside the Form IN-111 Instructions booklet for more information.

PA-1 Special Power of Attorney. Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax brackets. This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government.

4 rows Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax. The table below shows rates and brackets for the four main filing statuses in Vermont. Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021.

Then your VT Tax is. Vermont School District Codes. The latest available tax rates are for 2020 and the vermont income tax brackets have been changed since 2004.

Rates range from 335 to 875. The site is secure. Location Option Sales Tax.

18 18 18 18. 2017-2018 Income Tax Withholding Instructions Tables and Charts. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

Local Option Alcoholic Beverage Tax. The Vermont State Tax Tables for 2021 displayed on this page are provided in support of the. The Vermont Department of Revenue is responsible for publishing the.

The Vermont State Tax Tables for 2022 displayed on this page are provided in support of the. State government websites often end in gov or mil. This tool compares the tax brackets for single individuals in each.

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it. Your 2021 Tax Bracket to See Whats Been Adjusted. Vermont based on relative income and earningsVermont state income taxes are listed below.

In addition check out your federal tax rate. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. Discover Helpful Information and Resources on Taxes From AARP.

2017 VT Rate Schedules. Ad Compare Your 2022 Tax Bracket vs. 2019 Income Tax Withholding Instructions Tables and Charts.

Vermont Tax Brackets for Tax Year 2021. IN-111 Vermont Income Tax Return. 5 5 5 5.

For income taxes in all fifty states see the income tax by state. Counties and cities can charge an additional local. 12 12 12 12.

The state income tax system in vermont is a progressive tax system. Vermont State Tax Brackets. Vermont Percentage Method Withholding Tables for wages paid in 2020.

This column also applies to qualifying widower and civil union filing jointly status This column also applies to civil union filing separately status. 2022 Vermont state sales tax. Tax Rate Single Married.

We last updated Vermont Tax Tables in March 2022 from the Vermont Department of Taxes. 9 Vermont Meals Rooms Tax Schedule. RateSched-2021pdf 3251 KB File Format.

We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. 0 0 0 0. 5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875.

Vermont State Income Tax Forms for Tax Year 2021 Jan. Before sharing sensitive information make sure youre on a state government site. Local Option Meals and Rooms Tax.

Tax Bracket Tax Rate. 2016 VT Rate Schedules and Tax Tables. 15 15 15 15.

6 Vermont Sales Tax Schedule. 2021 Tax Brackets and Income ranges will be listed here as they become available. 7500 25 Of the amount over 50000.

0 - 403500 - 6745066. Tax Bracket Marginal Corporate Income Tax Rate. For an in-depth comparison try using our.

Visit the Vermont and Connecticut income tax pages. W-4VT Employees Withholding Allowance Certificate. 2020 Vermont Tax Tables.

Income tax brackets are required state taxes in. The Vermont State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Vermont State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Vermont Income Taxes.

Exact tax amount may vary for different items. 8 8 8 8.

Vermont Income Tax Vt State Tax Calculator Community Tax

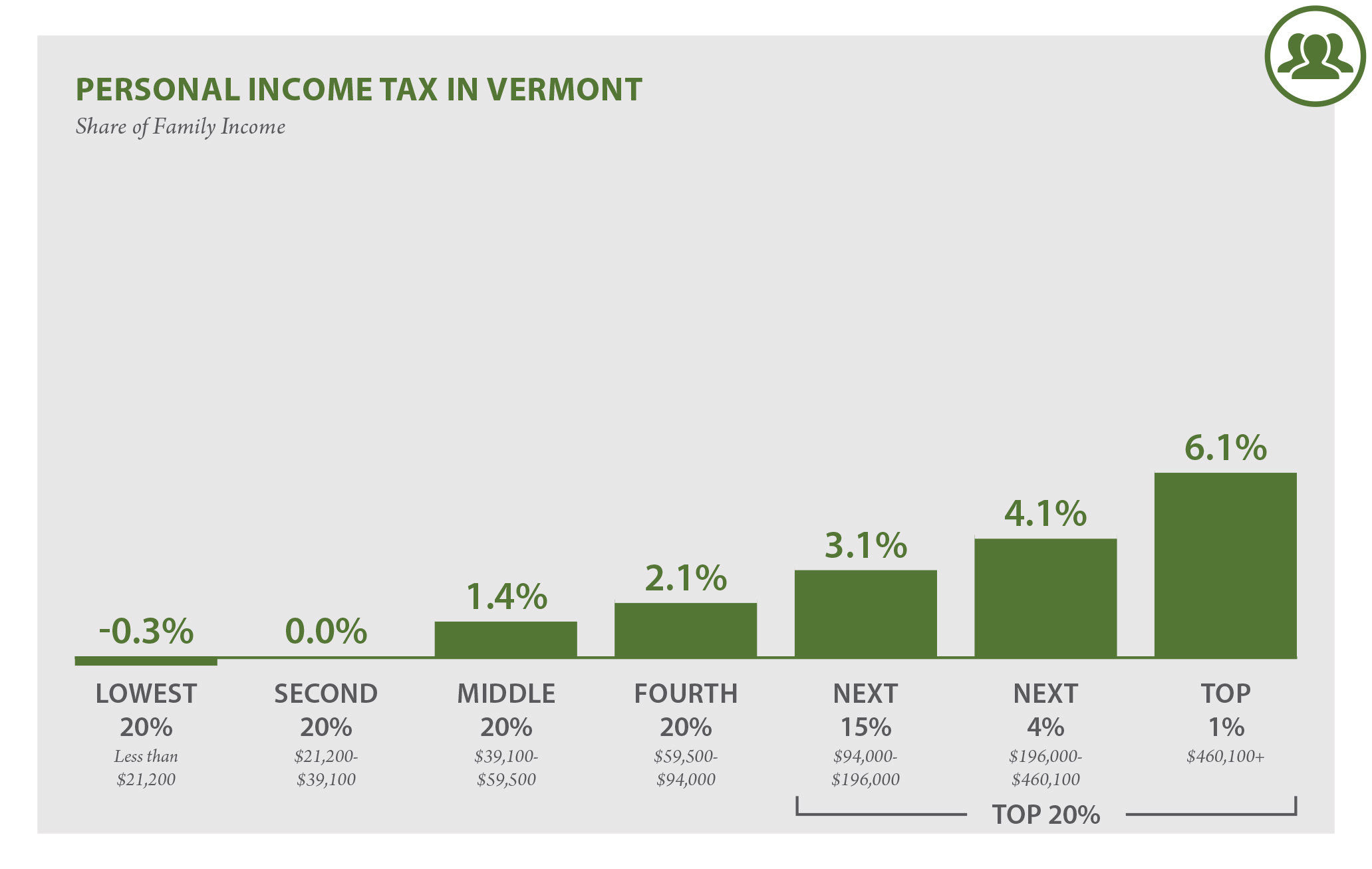

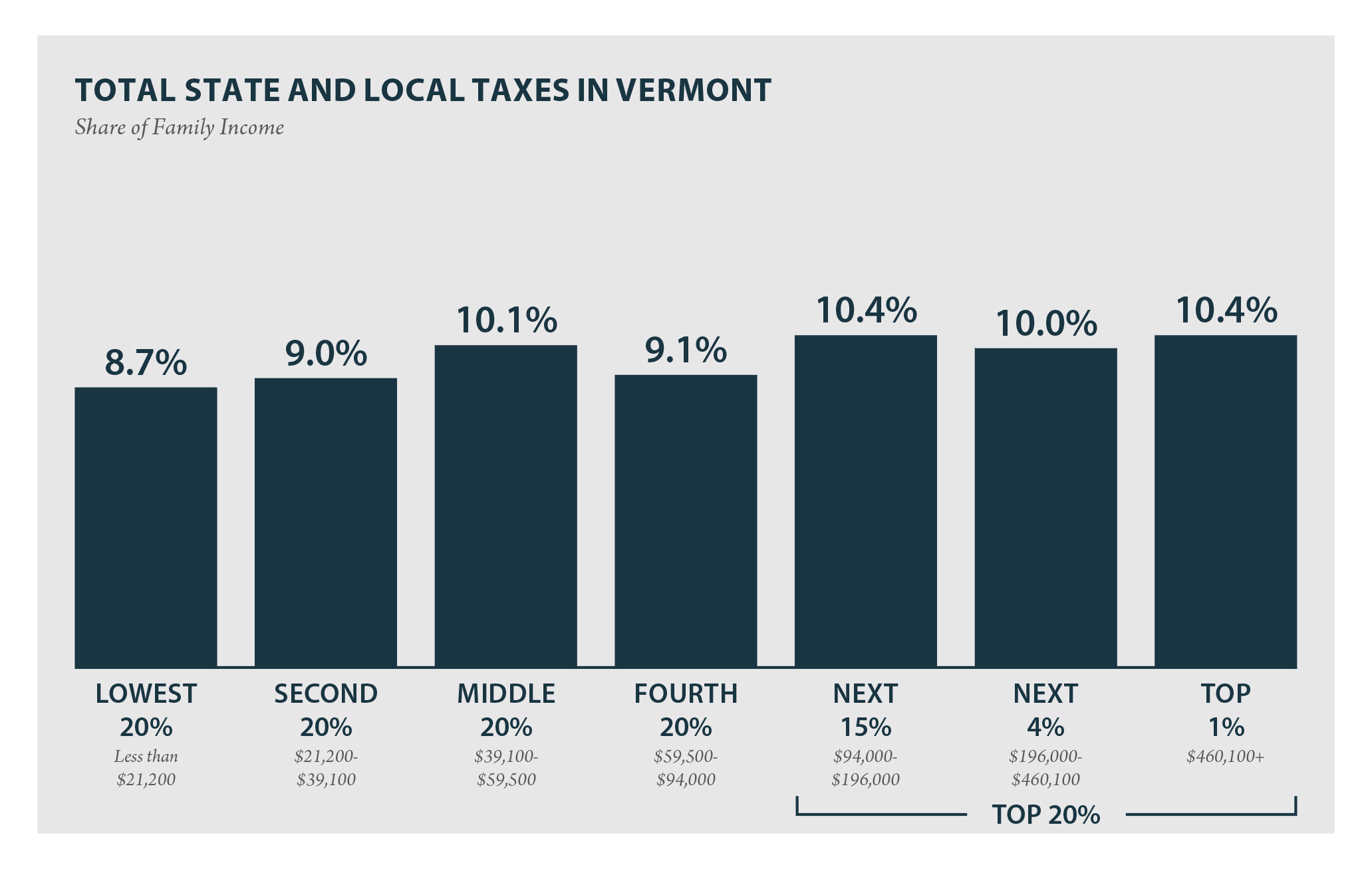

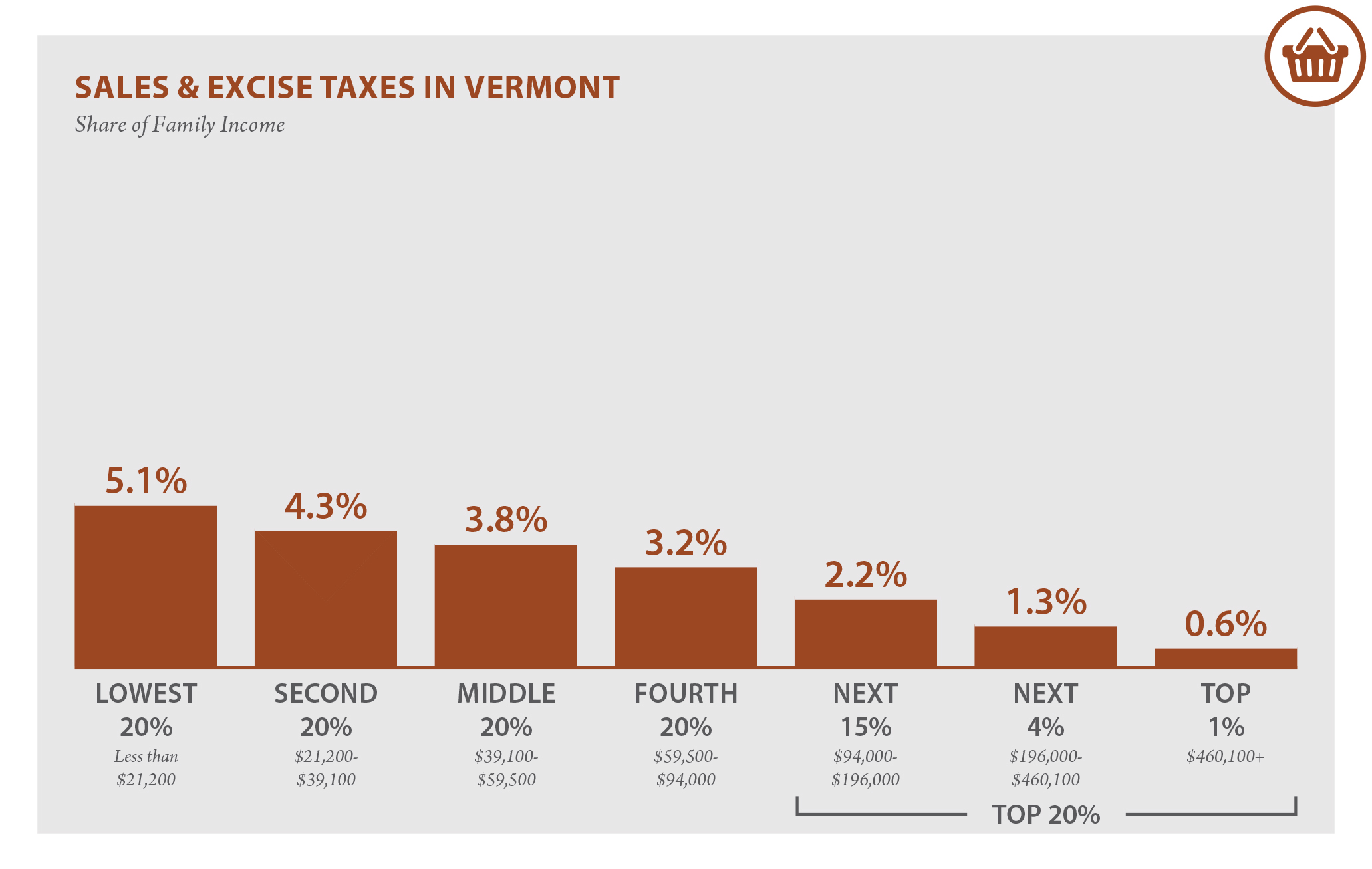

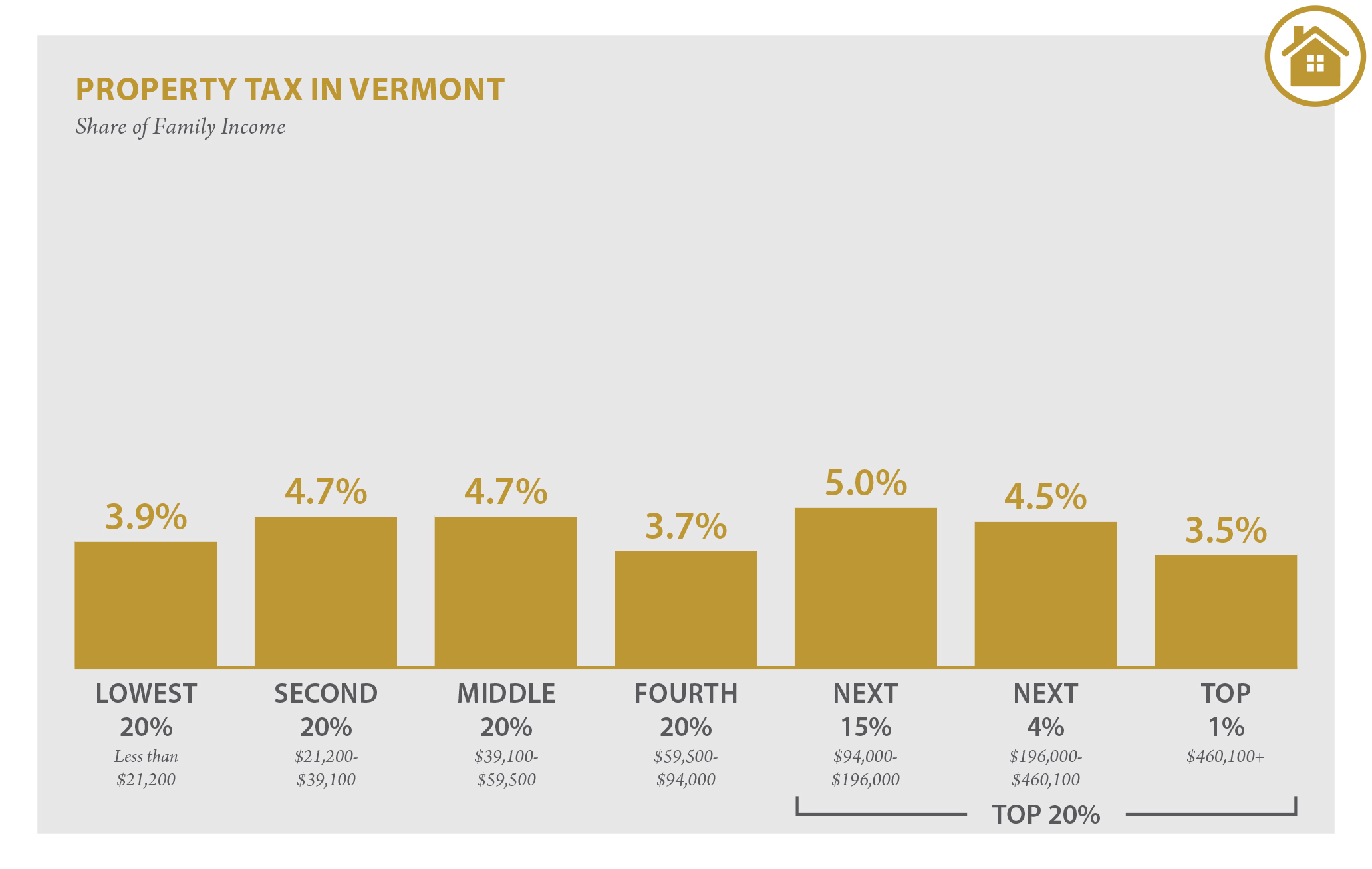

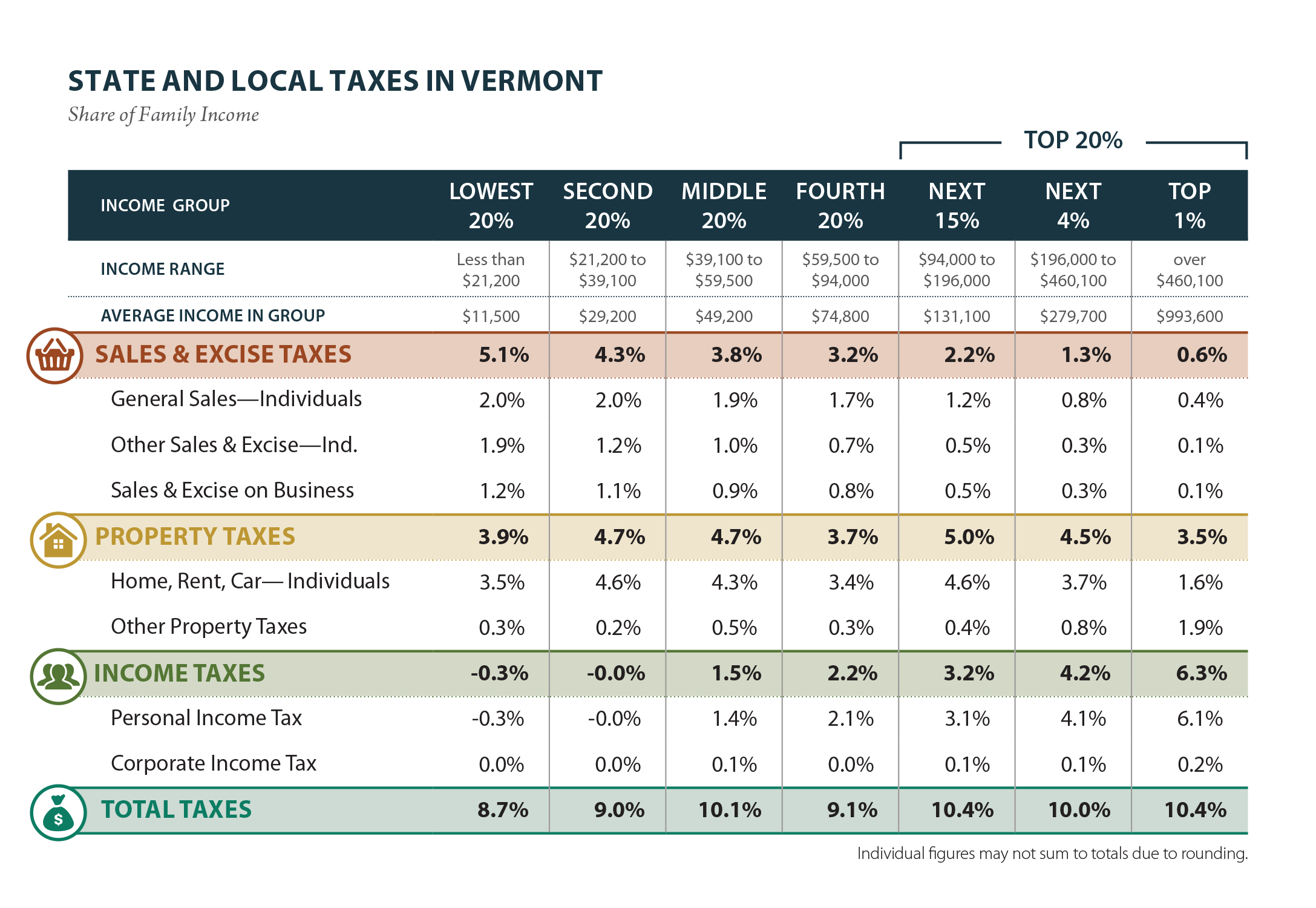

Vermont Who Pays 6th Edition Itep

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Vt State Tax Calculator Community Tax

Where S My Vermont State Tax Refund Taxact Blog

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

Vermont Who Pays 6th Edition Itep

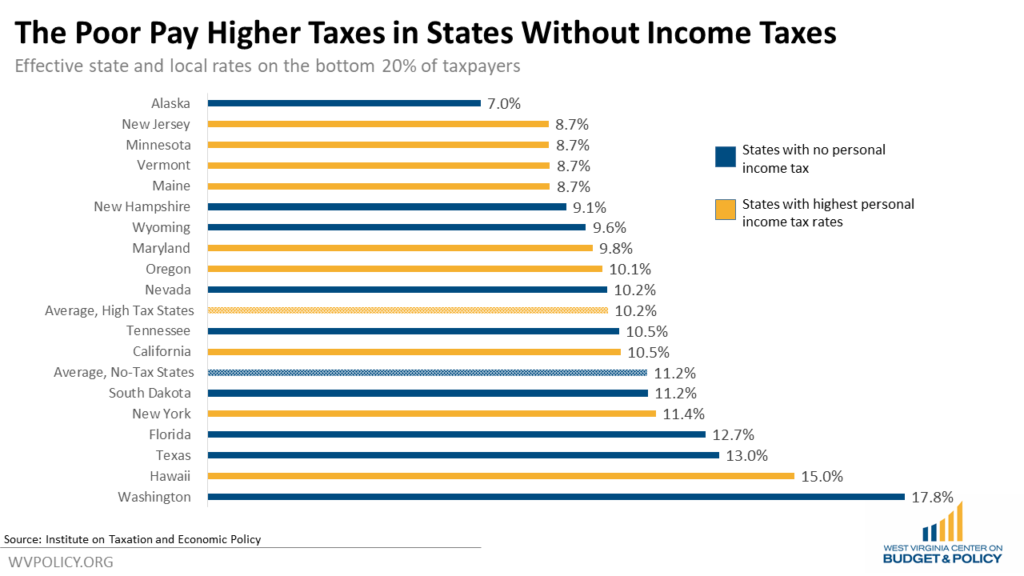

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy

Vermont Who Pays 6th Edition Itep

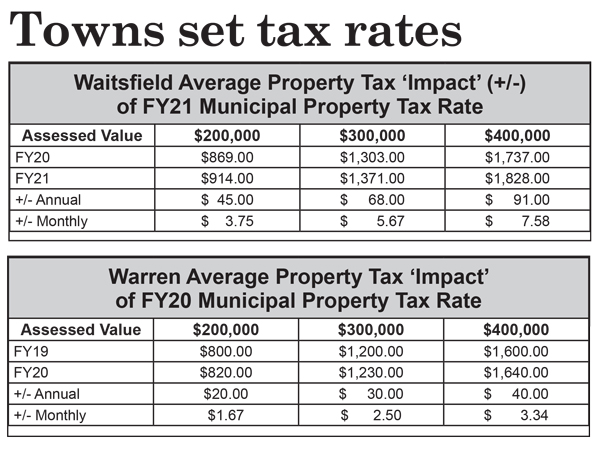

Vermont Property Tax Rates Nancy Jenkins Real Estate

Historical Vermont Tax Policy Information Ballotpedia

Effective State Income Tax Map Public Assets Institute

Vermont Who Pays 6th Edition Itep

Vermont Sales Tax Small Business Guide Truic

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map